As a founder, your time is your most precious resource. The hunt for affordable accounting software for startups is really about buying back hours from tedious financial admin so you can invest them in growth. The right platform simplifies complexity, brings clarity to your cash flow, and helps you build a financially sound business from the ground up.

This guide is your strategic playbook. We’ll cut through the marketing noise and dive into the best tools, sharing real-world insights to help you choose the perfect financial partner for your startup’s unique journey. Let’s turn your finances from a chore into a competitive advantage.

Why Your Startup’s Financial Health Depends on More Than a Spreadsheet

The financial story of most startups begins with a spreadsheet. It’s free, it’s familiar, and for a short while, it works. But as your business gains traction, that simple grid quickly becomes a liability—a tangled mess of formulas, broken links, and potential errors. This is the critical juncture where dedicated accounting software evolves from a “nice-to-have” to a non-negotiable tool for survival.

Adopting proper software is a strategic decision, not just an operational one. It automates the error-prone tasks that can lead to cash flow crises and tax season nightmares. More importantly, it provides a live, accurate dashboard of your business’s financial pulse. This empowers you to manage your runway with confidence, make data-driven pivots, and present a professional, buttoned-up image to investors. Choosing the right affordable accounting software for startups is a foundational investment in your company’s long-term resilience and success.

My Journey from Spreadsheet Purgatory to Financial Command

I’ll never forget the day our DIY financial system officially imploded. We were running a small digital marketing agency, and for the first six months, Google Sheets was our financial nerve center. Then, we had a breakout quarter, onboarding several large clients at once. Suddenly, the administrative workload became a tidal wave.

I lost an entire weekend trying to reconcile our accounts for a quarterly review. The outcome was grim: we had missed invoicing a client for a significant project, double-paid a vendor, and completely overlooked a contractor’s payment. The stress was immense, but the real cost was the lost focus. I was so deep in financial admin that I wasn’t steering the ship. That was the wake-up call.

We needed a tool built for a service-based business. After testing a few options, we settled on FreshBooks. It was designed for agencies and consultants, which felt like it was speaking our language. The difference was staggering.

- What I Valued Most (The Strengths):

- Effortless Invoicing and Payments: Creating and sending professional invoices took minutes. The automated payment reminders feature alone probably saved me five to ten hours a month of chasing down payments.

- Time Tracking That Makes Sense: The built-in time tracker was a revelation. We could track every billable minute against a specific project and then pull that data directly into a client’s invoice with a single click.

- True Project Profitability: For the first time, we had a clear picture of how profitable each client and project was. By tracking income against logged hours and expenses, we gained the insight needed to refine our pricing and focus on high-value work.

- An Elevated Client Experience: The client portal, where clients could view invoices, make payments, and see project updates, instantly made our small agency feel more professional and organized.

- Where It Had Room to Grow (The Trade-offs):

- Not Built for Inventory: FreshBooks is laser-focused on service businesses. Its inventory management features are minimal at best, so it would have been a disastrous choice if we were selling physical products.

- Simpler Reporting: While the standard reports were perfect for day-to-day management, I sometimes wished for the deeper, more customizable analytics that platforms like QuickBooks offer for complex forecasting.

This experience crystallized a core truth for me: the “best” software is the one that solves your most pressing business problem. For our service-based startup, FreshBooks was a perfect fit. For a retail brand or a growing SaaS company, the ideal solution would undoubtedly be different.

The First Big Choice: Cloud Freedom vs. On-Premise Control

When you start looking at accounting software, you’ll encounter a fundamental fork in the road: should your financial data live securely online in the cloud, or on your own computers in an on-premise system? While the startup world has largely chosen a side, understanding both is crucial for making a smart decision.

Cloud-Based Accounting Software: Your Financial Hub, Anywhere

Cloud-based accounting software is hosted on the vendor’s secure servers and accessed through your web browser or a dedicated mobile app. This model, known as Software-as-a-Service (SaaS), is the overwhelming favorite for modern startups because it’s built for the speed, flexibility, and remote-first nature of today’s business environment.

The market data overwhelmingly supports this trend. Reports from firms like Allied Market Research project continued explosive growth in the cloud accounting sector, showing it’s a fundamental shift in how businesses operate.

Why the Cloud Is the Startup Standard:

- Work from Anywhere, Anytime: Manage your finances from your office, your home, or a coffee shop across the country. Your financial data is no longer tied to a specific piece of hardware.

- Zero IT Headaches: The provider handles all security updates, server maintenance, and new feature rollouts. You always have the latest, most secure version without lifting a finger.

- Budget-Friendly Scalability: Subscription models allow you to start with an affordable plan and seamlessly upgrade as your revenue and team grow. You avoid the massive upfront cost of an enterprise system.

- Effortless Collaboration: Securely invite your accountant, bookkeeper, or co-founder to access your books in real-time, eliminating the insecure and inefficient process of emailing sensitive files.

On-Premise Accounting Software: The Data Fortress

On-premise accounting software follows the traditional model: you buy a software license and install it directly onto your local computers and servers. This creates a self-contained system that you own and control completely.

While less common for nimble startups, this path can be a necessity for businesses in highly regulated industries, such as government contracting, advanced biotech, or finance, where data residency and security protocols may prohibit the use of third-party cloud servers.

When On-Premise Might Be Necessary:

- Absolute Data Sovereignty: Your financial data resides on your own hardware, under your complete control.

- A Different Cost Model: A large, one-time license fee can feel steep but may be more economical over a 5-10 year horizon compared to a perpetual monthly subscription.

- Offline Reliability: You can access your financial data even if your internet connection is down, which can be critical in areas with spotty service.

- Deep Customization: On-premise systems can sometimes offer more profound and specific customizations to integrate with other legacy enterprise systems.

Despite these specific use cases, the powerful combination of flexibility, low upfront cost, and collaborative efficiency makes cloud-based accounting software the clear and correct choice for the vast majority of startups.

The Founder’s Shortlist: Top Affordable Accounting Platforms

The market for accounting tools can feel saturated. To help you find a signal in the noise, here is a pragmatic breakdown of the top players, focused on their core philosophies and who they serve best.

1. Wave: The Best Free Starting Point for Bootstrappers

For founders building their dream on a shoestring budget, Wave is nothing short of a miracle. It offers a surprisingly powerful suite of core accounting, invoicing, and receipt-scanning tools for the unbeatable price of zero.

- Best For: Freelancers, solopreneurs, and brand-new startups where every penny counts.

- The Highlights:

- Genuinely Free, Professional Accounting: It’s a legitimate double-entry accounting system that costs nothing for its core functionality.

- No Artificial Limits on Basics: You can send unlimited invoices and connect as many bank accounts as you need without hitting a paywall.

- Polished First Impression: The invoice templates are clean and customizable, helping your new venture look established from day one.

- The Trade-offs:

- The Integration Gap: Wave’s most significant weakness is its inability to connect with many other business apps. As your tech stack grows, this can become a major operational bottleneck.

- Lacks Advanced Automation: It doesn’t have the sophisticated bank rules or automated workflows that you’ll find in its paid competitors.

- Where They Make Money: Wave’s business model relies on charging for optional, integrated services like payment processing (Wave Payments) and payroll.

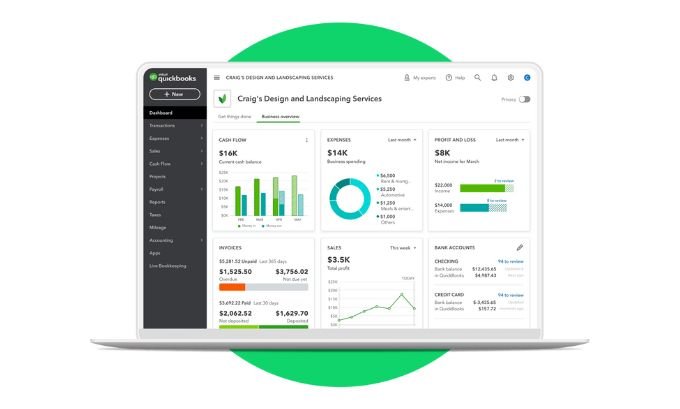

2. QuickBooks Online: The Scalable, All-in-One Powerhouse

QuickBooks Online is the 800-pound gorilla in the small business accounting space for a reason. It’s a comprehensive, feature-rich platform that can comfortably support a company from its first sale all the way to a public offering.

- Best For: Ambitious startups, especially in e-commerce or retail, that anticipate rapid growth and need an all-in-one solution that scales with them.

- The Highlights:

- Unmatched Scalability: With a wide range of plans, you can add powerful features like advanced inventory management, project profitability, and deep analytics as your business needs evolve.

- The App Ecosystem: QuickBooks integrates with thousands of third-party applications, allowing it to become the central hub for your entire business operation.

- The Accountant’s Lingua Franca: Nearly every accountant in North America is fluent in QuickBooks, which makes tax time and financial advising incredibly smooth.

- The Trade-offs:

- The Complexity Curve: With great power comes great complexity. The sheer number of features can be overwhelming for a simple business or a founder new to accounting.

- The Climbing Cost: The subscription fees can escalate quickly as you move up the tiers and add essential services like payroll.

If you’re looking to explore more about affordable accounting software for startups , visit this websites 👇 which offer valuable resource s and up-to-date information for entrepreneurs. 👇

gogonihon.jp.net

mumbaitimes.net

mindjournal.co

ponta.in

3. Xero: The Design-Forward, Collaborative Challenger

Xero is a top-tier QuickBooks competitor that wins fans with its beautiful design, intuitive user experience, and focus on collaboration. It’s a powerful piece of cloud-based accounting software that feels less like a legacy financial tool and more like modern technology.

- Best For: Growing startups with collaborative teams who value a clean interface and don’t want to be penalized for adding users.

- The Highlights:

- Unlimited Users, Always: This is Xero’s killer feature. Every plan, from the cheapest to the most expensive, includes unlimited users, offering incredible value as your team expands.

- An Intuitive Experience: Many founders find Xero’s workflow and navigation more logical and less intimidating than its more complex competitors.

- Strong Core Functionality: It excels at bank reconciliation, invoicing, bill pay, and project tracking, all presented in a clean, elegant package.

- The Trade-offs:

- The Starter Plan’s Limitations: The entry-level “Early” plan is quite restrictive, capping the number of invoices and bills you can process. Most businesses will need to begin on the “Growing” plan.

- Support via Ticket: Customer support is handled primarily through an online ticketing system, which can be frustrating when you’re facing an urgent problem and need an immediate answer.

4. Zeni: The White-Glove Finance Service for Tech Startups

Zeni exists in a category of its own. It is not just software; it is a managed financial service. It combines an AI-powered platform with a dedicated team of human finance experts, effectively serving as an outsourced finance department for high-growth SaaS companies and tech startups.

- Best For: Venture-backed startups that have moved beyond basic bookkeeping and require sophisticated financial management, strategic reporting, and expert oversight.

- The Highlights:

- Daily Financial Reconciliation: Your books are updated every single day, not just monthly, giving you an unparalleled, real-time view of your financial health.

- An Entire Finance Team on Demand: The service includes access to bookkeepers, controllers, and fractional CFOs who can provide strategic guidance on everything from burn rate to fundraising.

- Purpose-Built for SaaS: The platform comes with pre-built dashboards for tracking the crucial metrics that matter to SaaS Companies: MRR, ARR, churn, LTV, and more.

- The Trade-offs:

- A Premium Investment: This is a high-touch, premium service with a price tag to match. It is not affordable accounting software for startups in the traditional, bootstrapped sense of the term.

- A “Done-for-You” Model: This is the perfect solution for founders who want to completely delegate their finances, but it is not the right fit for those who want to be hands-on with their own books.

Feature & Philosophy Comparison at a Glance

| Software | Core Philosophy | Best For… | Starting Price (Approx.) | You Might Look Elsewhere If… |

|---|---|---|---|---|

| Wave | “Powerful accounting should be free.” | Bootstrappers & Solopreneurs | $0/month | You need to integrate with other business apps. |

| FreshBooks | “Getting paid for your time should be easy.” | Service-Based Businesses & Agencies | ~$17/month | You sell physical products or have many clients on the basic plan. |

| Xero | “Collaboration and beautiful design matter.” | Growing, Collaborative Teams | ~$15/month | You need immediate phone support or have very few invoices. |

| QuickBooks | “Be the scalable, all-in-one financial hub.” | E-commerce & Businesses Planning Rapid Growth | ~$30/month | You crave simplicity and have a minimal budget. |

| Zeni | “Outsource your entire finance department.” | Funded Tech & SaaS Companies | Custom (High-end) | You are on a tight budget or prefer a DIY approach. |

Frequently Asked Questions (FAQ)

1. When is the absolute right time for my startup to get accounting software?

The best time is day one. While it’s tempting to put it off, establishing a professional system from the start is infinitely easier than trying to clean up and migrate months of chaotic spreadsheet data. Start as you mean to go on.

2. As a founder with no finance background, can I really do my own accounting?

Yes, absolutely—especially in the early days. Modern accounting software like Wave and FreshBooks is designed for business owners, not accountants. That said, it is always a wise investment to have a CPA or professional bookkeeper review your books periodically to ensure everything is in order.

3. What is “double-entry accounting,” and why is it important?

It’s the universally accepted method for business accounting. In simple terms, it means every transaction is recorded in at least two accounts—as a debit in one and a credit in another. This system ensures your financial records are always balanced and provides a clear, auditable trail. All reputable software platforms are built on this principle.

4. Is it really safe to use free accounting software like Wave?

Yes. Reputable free platforms like Wave use bank-level, 256-bit encryption to protect your financial data. Their business model is not based on selling your information; it’s based on converting happy free users to their optional, paid services like payroll and payment processing.

5. How much should I realistically budget for accounting software as a new startup?

You can start for $0 with a platform like Wave. For a more robust paid plan that offers greater automation and scalability, a reasonable starting budget is between $30 and $70 per month. This cost will naturally increase as your business grows and your needs become more complex.

6. I run a SaaS company. What is the single most critical feature for me?

For SaaS Companies, the most important feature is automated revenue recognition. You need a system that can handle the complexities of subscription billing (e.g., properly recognizing monthly revenue from a prepaid annual contract) and provide clear dashboards for key metrics like Monthly Recurring Revenue (MRR) and churn rate.

7. Should I just use whatever software my accountant recommends?

Your accountant’s preference is a very important factor, as it makes collaboration much smoother. However, you are the one who will be using the software every day. Choose the platform that best fits your business model and workflow, and that you find the most intuitive to use. Most modern accountants are proficient in several major platforms.

Your Next Move: From Information to Action

Choosing the right affordable accounting software for your startup is a strategic decision that pays dividends in time, clarity, and confidence. It transforms your financial data from a static record of the past into a dynamic tool for shaping the future.

The best way forward is to act. Don’t get stuck in the cycle of endless research. Identify the one or two features that would make the biggest immediate impact on your business. Then, sign up for a free trial of the top two contenders on your list. Get a feel for the workflow. See which one “clicks.” Taking this step is a powerful move toward building a more resilient, data-driven, and ultimately more successful company.