Managing your business’s cash flow effectively can mean the difference between thriving and barely surviving. Cash flow management is the strategic process of monitoring, analyzing, and optimizing how money moves in and out of your business. When done right, it provides the financial stability every small business needs to grow sustainably.

This comprehensive guide will walk you through proven strategies, essential tools, and real-world examples to help you master how to manage cash flow in a small business. By the end, you’ll have a clear roadmap to maintain healthy cash flow and position your business for long-term success.

Table of Content

What is Cash Flow Management?

Cash flow management is the systematic approach to tracking, analyzing, and controlling the inflow and outflow of money in your business. It ensures you have enough liquid funds available to meet your financial obligations while maximizing opportunities for growth and investment.

At its core, cash flow management involves understanding the difference between cash inflow (money coming in from sales, investments, and other sources) and cash outflow (expenses like rent, payroll, inventory, and operational costs). The goal is to maintain a positive cash flow where more money flows in than goes out.

Effective cash flow management strategies help small businesses avoid the trap of being profitable on paper but cash-poor in reality. This distinction is crucial because many businesses fail not due to lack of profitability, but due to poor cash flow timing.

Why Cash Flow Management is Critical for Small Businesses

Small businesses face unique challenges that make cash flow management even more essential. Unlike large corporations with substantial cash reserves and credit lines, small businesses operate with limited financial buffers.

Predict and Prevent Financial Shortfalls

Effective cash flow management helps you identify potential cash gaps before they become critical. When you can see a shortfall coming weeks or months in advance, you have time to take corrective action. This might include accelerating collections, delaying non-essential purchases, or securing short-term financing.

Reduce Business Stress and Uncertainty

Financial uncertainty creates significant stress for business owners. When you have a clear picture of your cash flow, you can make informed decisions with confidence. You’ll know exactly how much money you have available for growth investments, equipment purchases, or handling unexpected expenses.

Make Strategic Growth Decisions

Understanding your cash flow patterns enables you to identify the best times to invest in growth. You can determine when you have sufficient cash reserves to hire new employees, launch marketing campaigns, or expand into new markets without jeopardizing your operations.

Build Credibility with Lenders and Suppliers

Banks and suppliers appreciate working with businesses that demonstrate strong financial management. A well-documented cash flow statement and forecasting system shows that you’re a reliable partner who understands their financial position.

10 Essential Cash Flow Management Strategies

1. Create Accurate Cash Flow Forecasting

Cash flow forecasting forms the foundation of effective financial management. This involves projecting your expected cash inflows and outflows over specific periods, typically weekly or monthly.

Start by analyzing your historical data to identify patterns. Most businesses experience seasonal fluctuations, and understanding these cycles helps you prepare for slower periods. Include all income sources and expenses in your forecast, from major customer payments to small recurring subscriptions.

The key to successful forecasting is regular updates. Review and adjust your projections weekly based on actual performance and new information. This practice helps you stay ahead of potential problems and identify opportunities for optimization.

2. Implement Strategic Inventory Control

Inventory control directly impacts your cash flow by determining how much working capital is tied up in unsold products. Too much inventory drains cash, while too little can lead to stockouts and lost sales.

Conduct regular ABC analysis to categorize your products by sales velocity and profitability. Focus your cash investment on fast-moving, high-margin items while reducing slow-moving inventory through discounts or promotions.

Consider just-in-time ordering for non-critical items, and negotiate with suppliers for shorter payment terms or consignment arrangements where possible.

3. Optimize Payment Terms and Collections

Accelerating cash inflows is often easier than reducing expenses. Implement systems to send invoices immediately upon delivery and offer incentives for early payment, such as 2% discount for payments within 10 days.

Establish clear payment terms and follow up promptly on overdue accounts. Consider requiring deposits or partial payments upfront for large orders, especially for new customers.

For businesses looking to streamline their financial operations, exploring warehouse management software for small business can help optimize inventory turnover and improve cash flow timing.

4. Develop Alternative Revenue Streams

Diversifying your income sources reduces dependence on a single revenue stream and can improve cash flow consistency. Alternative revenue streams might include complementary products, subscription services, or seasonal offerings.

For example, a retail business might add repair services, while a consulting firm could create online courses or digital products. The key is choosing revenue streams that leverage your existing expertise and customer relationships.

5. Negotiate Favorable Supplier Terms

Work with your suppliers to establish payment terms that align with your cash flow cycle. If you typically collect from customers in 30 days, negotiate 45-60 day payment terms with suppliers to create a positive cash flow gap.

Many suppliers offer early payment discounts, which can be worthwhile if you have excess cash. Calculate the annualized return on these discounts to determine if they’re better than other investment opportunities.

6. Establish an Emergency Fund

Building an emergency fund equivalent to 3-6 months of operating expenses provides a crucial safety net. This fund helps you weather unexpected challenges like equipment failures, economic downturns, or temporary loss of major customers.

Treat your emergency fund as insurance, not an investment. Keep it in a high-yield savings account where it’s easily accessible but earning some return while not in use.

7. Lease Instead of Purchase Major Assets

Leasing equipment and vehicles can significantly improve cash flow by reducing large upfront payments. This strategy preserves working capital for day-to-day operations and growth investments.

Leasing also provides tax advantages in many cases and ensures you’re using current technology without the burden of obsolescence. Evaluate the total cost of ownership versus leasing for each major purchase decision.

8. Utilize Technology and Automation

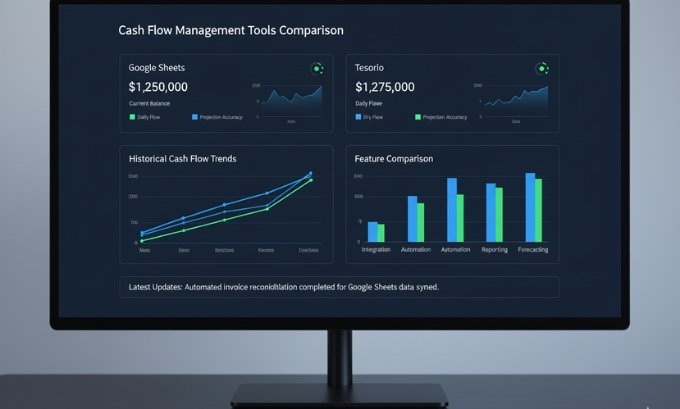

Modern cash flow management tools can automate many time-consuming tasks while providing better visibility into your financial position. Platforms like Tesorio offer comprehensive dashboards that integrate with your existing accounting systems to provide real-time cash flow insights.

For businesses just starting with digital tools, Google Sheets templates can provide a cost-effective foundation for cash flow tracking and forecasting. As you grow, consider upgrading to specialized platforms like Jirav for more sophisticated analysis and reporting.

9. Monitor Key Performance Indicators

Track metrics that directly impact cash flow, including:

- Days Sales Outstanding (DSO)

- Inventory turnover ratio

- Accounts payable days

- Cash conversion cycle

- Monthly recurring revenue (for subscription businesses)

Regular monitoring of these KPIs helps identify trends and potential issues before they impact your cash position.

10. Build Strong Banking Relationships

Establish relationships with multiple financial institutions to ensure access to credit when needed. Many banks offer small business lines of credit that can provide short-term cash flow flexibility during challenging periods.

Consider working with community banks that understand local business conditions and may offer more personalized service and flexible terms than larger institutions.

Essential Cash Flow Management Tools

Google Sheets for Simple Tracking

For small businesses with straightforward needs, Google Sheets provides an accessible starting point. Free templates allow you to track income and expenses, create basic forecasts, and monitor cash balances across multiple accounts.

The main advantages include zero cost, easy collaboration with team members, and integration with other Google Workspace tools. However, as your business grows, you’ll likely need more sophisticated features.

Tesorio for Advanced Analytics

Tesorio offers comprehensive cash flow management with features including automated bank reconciliation, predictive analytics, and collaborative planning tools. The platform integrates with major accounting systems and provides real-time visibility into your financial position.

This solution works best for businesses with complex cash flows, multiple revenue streams, or those requiring detailed reporting for investors or lenders.

Jirav for Comprehensive Financial Planning

Jirav combines cash flow management with broader financial planning capabilities. The platform offers scenario modeling, budgeting tools, and executive dashboards that provide a holistic view of your business’s financial health.

Consider Jirav if you need to integrate cash flow management with strategic planning and reporting for stakeholders who want to explore digital transformation strategies for their financial processes.

Real-World Cash Flow Management Example

Consider Sarah, who runs a boutique marketing agency with 12 employees. She noticed her cash flow became tight during the first quarter of each year when many clients delayed projects due to budget planning cycles.

Sarah implemented several strategies to address this challenge:

- Diversified client base: She expanded into industries with different seasonal patterns

- Adjusted payment terms: Required 50% deposits on new projects

- Built recurring revenue: Added monthly retainer services alongside project work

- Created seasonal reserves: Set aside extra cash during peak months

Within 18 months, Sarah transformed her Q1 cash flow crisis into a manageable seasonal variation. Her small business ideas for recurring revenue helped stabilize cash flow throughout the year.

Common Cash Flow Management Mistakes to Avoid

Confusing Profit with Cash Flow

Profitability doesn’t guarantee positive cash flow. A business can show profits on the income statement while struggling with cash shortages due to timing differences between sales and collections.

Neglecting Accounts Receivable Management

Allowing customer payments to drag beyond agreed terms ties up working capital unnecessarily. Implement systematic collection procedures and consider factoring or invoice financing for immediate cash needs.

Over-investing in Inventory

Excess inventory represents cash that could be deployed elsewhere in the business. Regular inventory analysis and turnover optimization help maintain appropriate stock levels.

Ignoring Seasonal Patterns

Most businesses experience predictable seasonal fluctuations. Plan for these patterns by building cash reserves during peak periods to support operations during slower months.

Frequently Asked Questions

What is the difference between cash flow and profit?

Profit measures revenue minus expenses over a period, while cash flow tracks the actual movement of money in and out of your business. You can be profitable but cash-poor if customers haven’t paid invoices yet or if you’ve invested heavily in inventory.

How often should I update my cash flow forecast?

Review and update your cash flow forecast weekly for optimal management. Monthly updates are the minimum frequency for most small businesses, but weekly reviews provide better visibility and allow for quicker responses to changes.

What’s a healthy cash flow ratio for small businesses?

A healthy current ratio (current assets divided by current liabilities) is typically between 1.2 and 2.0 for small businesses. However, the ideal ratio varies by industry and business model.

Should I use cash flow management software or spreadsheets?

Start with spreadsheets if you’re just beginning to track cash flow. As your business grows and complexity increases, dedicated software provides automation, better reporting, and integration with other business systems.

How much should I keep in my emergency fund?

Maintain 3-6 months of operating expenses in your emergency fund. Service businesses might need less due to lower overhead, while manufacturing or retail businesses often need more due to inventory and equipment requirements.

Can I improve cash flow without affecting customer relationships?

Yes, through strategies like offering multiple payment options, providing early payment discounts, and improving your billing processes. Focus on making it easier and more attractive for customers to pay promptly.

What financing options can help with cash flow gaps?

Consider lines of credit, invoice factoring, equipment financing, or short-term loans. For those exploring how to scale a business successfully, maintaining access to flexible financing becomes even more critical.

Taking Control of Your Financial Future

Mastering how to manage cash flow in a small business requires dedication, the right tools, and consistent execution. The strategies outlined in this guide provide a comprehensive framework for building financial stability and creating opportunities for sustainable growth.

Remember that cash flow management is an ongoing process, not a one-time activity. Regular monitoring, forecasting, and adjustment of your strategies ensure you stay ahead of potential challenges while maximizing opportunities.

For entrepreneurs looking to understand what is a business in its fundamental aspects, strong cash flow management represents one of the most critical operational competencies you can develop.

Start implementing these strategies today, beginning with cash flow forecasting and gradually adding more sophisticated tools and techniques as your business grows. With proper cash flow management, you’ll have the financial foundation needed to pursue your entrepreneurial vision with confidence.